Our journey with Digital transformation with our customers began several years back. Due to the circumstances of the last year, for many of our customers this has been brought to focus.

As a Digital practitioner, I interact with customers across industries. Financial services perhaps stand out for its focus on Digital Transformation. From customer acquisition to Risk mitigation, the financial services industry is investing heavily on the possibilities offered by Digital. Since it’s such a vast area that is spread across ecosystems, it makes sense to cover Financial services as different sub-parts. In this blog, I’ll focus on my conversations with insurance company leaders and how they are looking at the digital landscape with respect to their business.

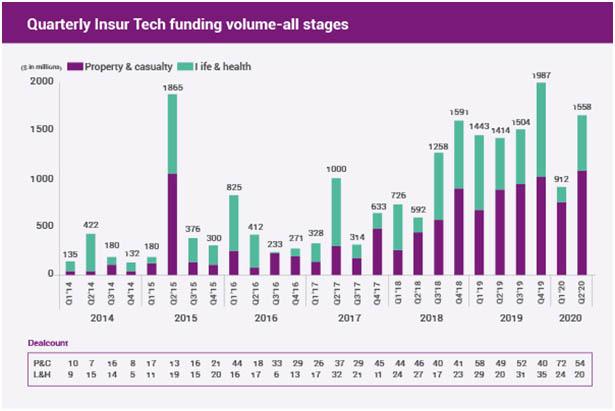

Insurance is no longer viewed by insurers as a stand-alone industry. It is increasingly part of an insurance ecosystem. The start-ups in the insurance industry have disrupted and integrated with insurance majors. Insurtech start-ups, aggregators, platforms, and ecosystems are key to the digital initiatives of traditional insurance organizations. The focus of insurance leaders is to integrate well and get the most out of these niche technology-driven players. The niche players are aggressive in their approach. Take the example of aggregators who compare insurance products and help insurance players acquire customers. Apart from having a very strong technological edge, they come with additional strengths such as credibility (as an impartial aggregator) and more importantly lean balance sheets – which give them the ability to disrupt without taking some of traditional insurer risks. The disruptor organizations are much more flexible and are expected to be a formidable challenge for traditional insurers.

It’s possible that this will most likely be the case in the India market as well. As such, the role of the channel in the Insurance business is well established in India – thanks to the large network of LIC agents. Powering this and replacing with technology wherever necessary, is very likely to happen. Aggregators are already making a mark in India.

In a recent report Mckinsey has called out four markers that indicate the readiness of traditional Insurers globally to thrive in the new ecosystem that includes the Digital attackers:

- How much of your customer acquisition is Digital?

- How well is the organization using Data, Analytics and AI – are you moving towards it as a core competency?

- Do you have state-of-the-art technology on the cloud?

- Talent management and the adaptability

This report is a clear recognition of the role technology will play in the future of insurance. Some large Insurers have made many of these points part of the strategic roadmap. Many of our insurance customers are approaching it in the following manner from a digital disruption viewpoint.

They are making a matrix for customer-acquisition and the potential to scale up.

- Identifying IT initiatives to make that happen

- Making this a part of the technology acquisition plan

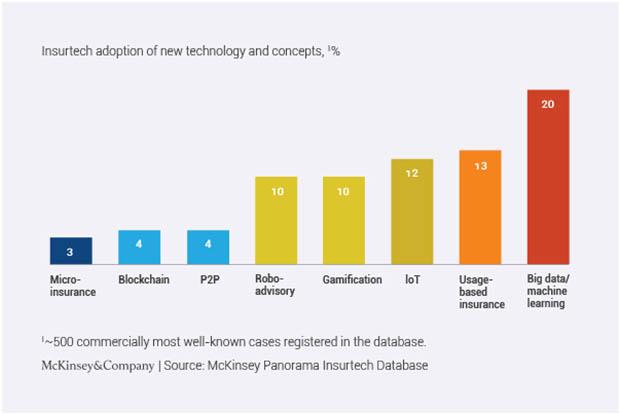

- Scaling up usage of Data- traditional and big data

- Analytics and AI initiatives plan

Some of the technology initiatives that will be very relevant in the given construct are:

- The initiatives mentioned above demand high-speed deployment and ability to adapt on the go – all internal developments will have to be agile. DevOps is a top priority for most insurance organizations.

- Having the right cloud strategy is imperative. Insurers are recognizing that much of their ecosystem already exists in the cloud and their ability to interact and integrate is something that will make them competitive.

- Ability to automate many of their traditional tasks. These tasks include not processes but also external-facing tasks such as customer acquisition. Some of our customers are at an advanced stage of their automation journey.

- Talent Management is critical. Traditional insurers have deep domain and customer expertise. Combined with the technology strengths of insurtech, the traditional insurers will be able to use technology as a growth hack. In order to leverage the best of the inhouse talent – insurance leaders have the following talent focuses

- Designing a digital workforce that scales up agility and talent

- Collaboration with resellers and aggregators

- Supporting talent initiatives through technology

It will be interesting to see another traditional industry attempt to use technology levers to reach out to markets and grow exponentially. Will this be the ATM moment for Insurance? There are signs that a major technology-led transformation is already underway. How many of you have bought insurance in an insurance providers office in the recent past?? Or for that matter paid your renewal insurance premium in that manner??

Data References:

https://www.mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/Insurtech%20the%20threat%20that%20inspires/Insurtech-the-threat-that-inspires.pdf

https://www.cbinsights.com/research/report/insurance-tech-q2-2020/